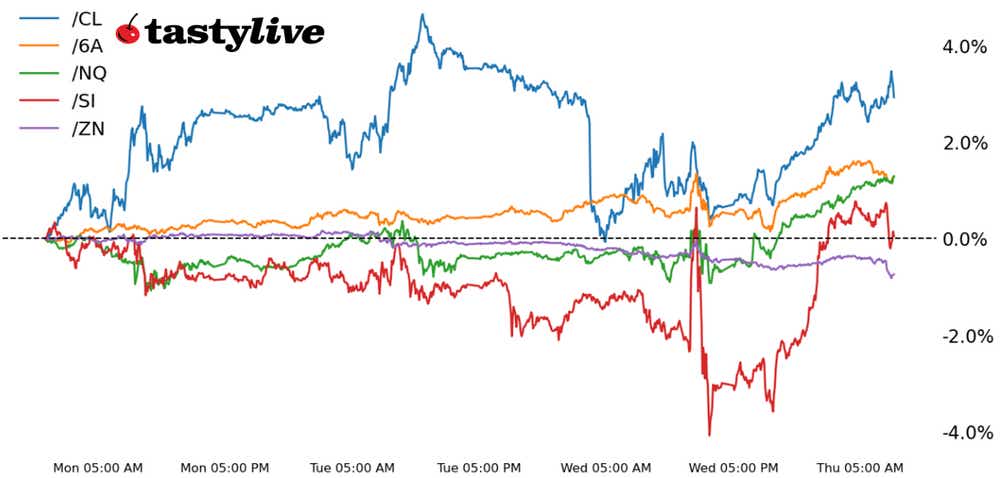

In a day marked by fluctuating market performances, the S&P 500 and Nasdaq Composite indices have risen, driven by a notable drop in oil prices. Meanwhile, the Dow Jones Industrial Average displayed mixed signals, showcasing the complex interplay of economic factors influencing investor sentiment.

Key Highlights:

- Rising Indices: The S&P 500 and Nasdaq saw significant gains, buoyed by positive investor reactions to the easing oil prices.

- Decline in Oil Prices: A decrease in oil prices often leads to lower inflation fears, prompting market rallies as industries reliant on oil benefit from reduced costs.

- Dow’s Mixed Performance: The Dow, however, struggled to maintain its footing, indicating a divergence in sector performance amidst the overall positive trend.

The decline in oil prices can have profound effects on the wider economy. As costs associated with transportation and manufacturing decrease, consumers often have more disposable income, potentially spurring economic growth. This is a welcoming development for sectors that had previously been affected by rising oil costs, especially amid ongoing inflation concerns.

Despite the Dow’s wavering performance, the upward momentum in the S&P 500 and Nasdaq signals a more optimistic economic outlook. Investors remain cautious yet encouraged, navigating the complexities of market dynamics with renewed interest.

As we look forward, analysts suggest keeping an eye on global oil market trends, inflation indicators, and macroeconomic policies, as these factors will continue to shape the performance of various sectors within the stock market.

In conclusion, the day’s trading reveals a fascinating market story. While the Dow wobbles, savvy investors are likely to find optimism in the rising tide of the S&P 500 and Nasdaq, reflecting a resilient economic landscape amid changing oil prices.

Leave a Reply