The Schwab High Yield Bond ETF has recently declared a monthly distribution of $0.3075, offering a promising opportunity for investors seeking income through high-yield bonds. This announcement highlights the ETF’s ongoing commitment to providing consistent cash distributions to its shareholders. Let’s take a closer look at what this means for investors and the implications of this decision in the current market landscape.

Key Highlights:

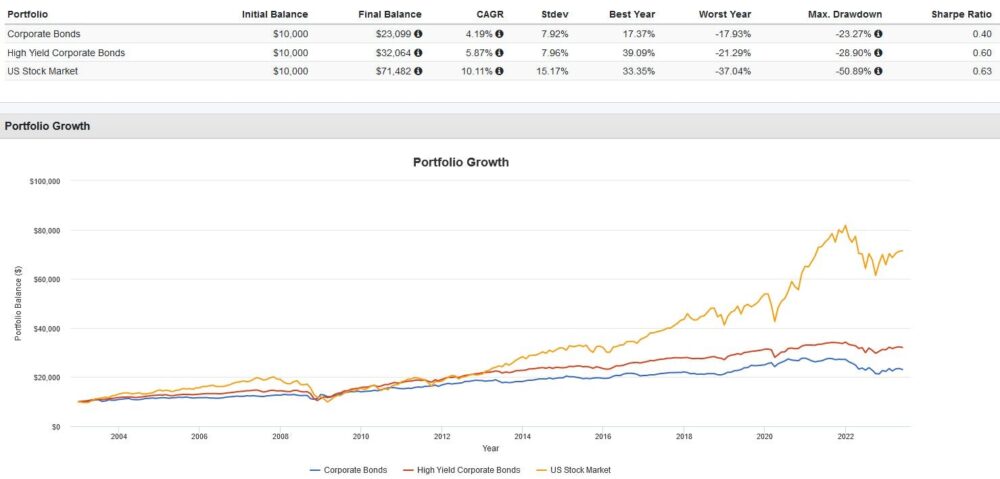

High yield bonds are often viewed as a riskier investment, typically offering higher returns to compensate for the increased credit risk. However, the decision by Schwab to maintain regular distributions reinforces confidence in the underlying assets and the ability to generate income in fluctuating interest rate environments.

For investors, this announcement can be seen as an encouraging sign that the Schwab High Yield Bond ETF is resilient in the face of market challenges and remains a viable option for portfolio diversification. The regular monthly payouts also provide an appealing element for those looking to fund living expenses or reinvest for greater capital accumulation.

In conclusion, the declaration of a $0.3075 monthly distribution by Schwab High Yield Bond ETF exemplifies a strong commitment to returning value to its investors. As always, potential investors should consider their risk tolerance and overall investment strategy before entering the high-yield bond market.

Stay tuned for more updates on the Schwab High Yield Bond ETF and other investment opportunities as we continue to monitor the evolving financial landscape.

Leave a Reply