In a noteworthy financial update, the iShares 20+ Year Treasury Bond ETF (TLT) has declared a monthly distribution of $0.31486 for its investors. This announcement signals continued confidence in the stability of long-term bonds, making it a relevant topic for both current investors and those contemplating entering the bond market.

### Key Highlights:

The decision to declare this distribution reflects TLT’s commitment to delivering consistent returns. Such monthly payouts can be particularly appealing to income-focused investors looking for steady cash flow amidst variable market conditions. Investors who prioritize long-term strategies may find this ETF aligns well with their investment goals, especially during times of uncertainty.

### Why Invest in TLT?

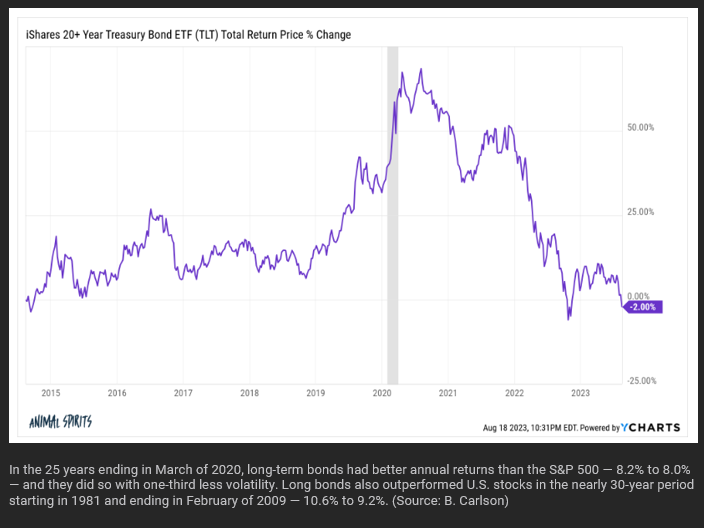

Investors typically gravitate towards Treasury bond ETFs like TLT due to their perceived safety and potential for stable income. Long-term bonds are often viewed as a hedge against inflation and market volatility, making them a cornerstone in diversified portfolios.

### Conclusion

With its latest distribution declaration, the iShares 20+ Year Treasury Bond ETF continues to reinforce its role as a reliable investment vehicle in the bond market. Whether you’re already a shareholder or considering investing, this announcement is a positive development worthy of attention. As always, it’s crucial for investors to conduct their own research and consider their individual financial situations before making investment decisions.

Leave a Reply