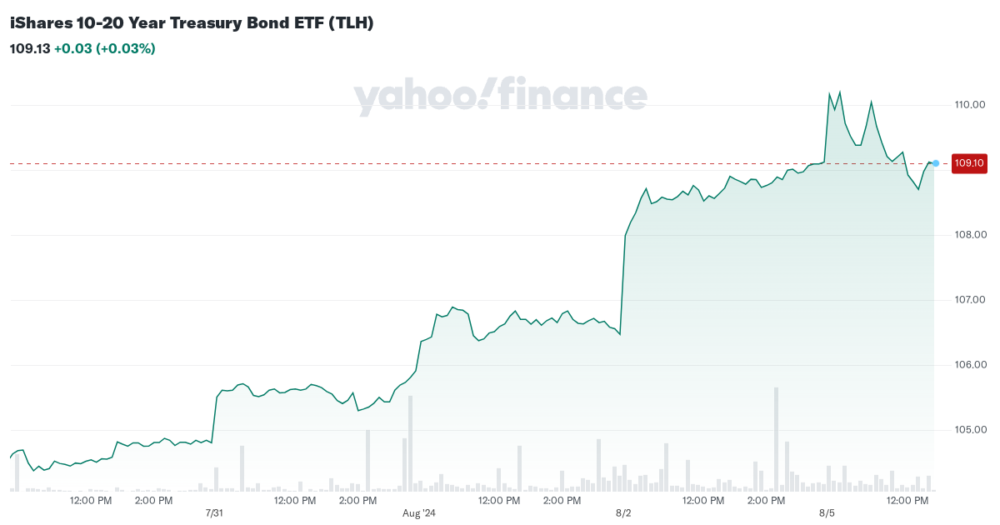

The iShares 10-20 Year Treasury Bond ETF (TLH) has made headlines by declaring its monthly distribution of $0.35107 for investors. This announcement reflects the ETF’s consistent commitment to delivering value to its shareholders, particularly during times of market fluctuation.

As a favored investment for those looking for stability, the iShares 10-20 Year Treasury Bond ETF is designed to track the performance of U.S. Treasury bonds with maturities between 10 to 20 years. With interest rates constantly in flux, this ETF provides an advantageous opportunity for investors seeking fixed-income securities.

Here are some key highlights of this announcement:

- Monthly Distribution Amount: $0.35107

- Focus on Stability: As bonds are considered safer investments, especially in uncertain economic times.

- Investment Strategy: TLH aims to offer long-term capital appreciation and monthly income.

- Investor Assurance: Regular distributions can indicate strong managerial oversight.

This distribution is especially significant in the current economic landscape, where many investors are seeking safer assets amid volatility. The iShares 10-20 Year Treasury Bond ETF stands out as a reliable option, offering consistent monthly yields and a robust portfolio grounded in U.S. government securities.

In conclusion, the announcement of the new monthly distribution of $0.35107 not only marks a positive step for TLH but also reaffirms the ETF’s role as a cornerstone in diversified investment portfolios. Those looking for stability and income can look forward to this distribution as a testament to the enduring value of government bonds in their investments.

Leave a Reply