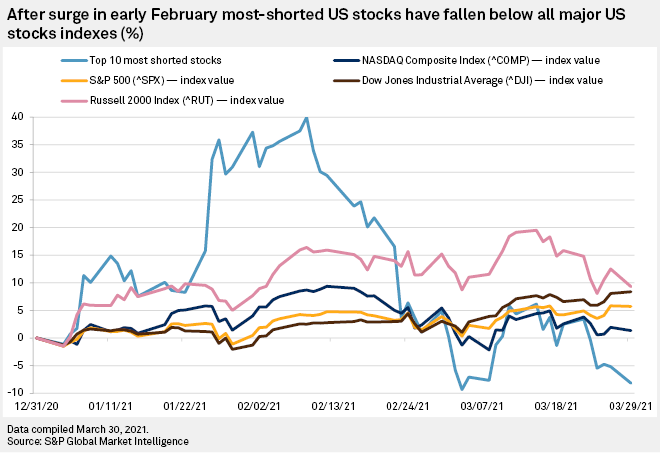

Understanding Heavily Shorted Stocks in today’s market is crucial for investors seeking opportunities beyond initial impressions. Recent analysis from S3 Partners revealed that heavily shorted stocks are not necessarily signs of financial distress. Instead, many of these stocks are experiencing strong performance, defying the common narrative that short-selling indicates trouble.

Here are some key insights from the study:

Given the current landscape, it is vital for investors to evaluate stocks with high short interest within a broader context. As the analysis from S3 Partners suggests, these stocks can offer lucrative opportunities rather than merely signaling distress.

In conclusion, staying informed and keen on market trends can empower investors to seize opportunities crafted from heavily shorted stocks, contrary to traditional beliefs about their viability.

Leave a Reply