Goldman’s Recent Downgrade: The latest report from Goldman Sachs indicating a downgrade in the outlook for U.S. economic growth has led to noteworthy shifts in the stock market. The changes reflect investor sentiment responding to altered projections for economic expansion, which highlights the intricate relationship between economic forecasts and stock performance.

Key Takeaways:

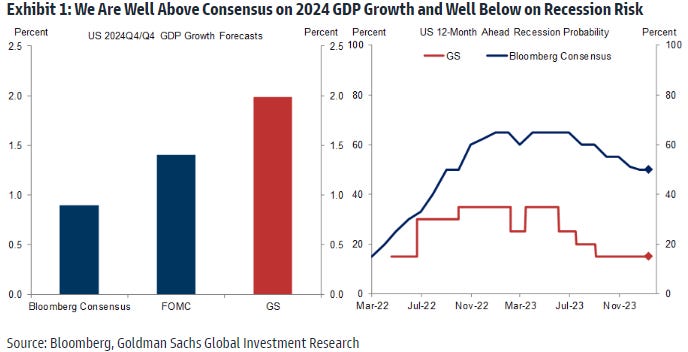

- The U.S. economy’s growth forecast has been revised downward, primarily due to weaker-than-expected performance indicators.

- This downgrade has triggered a re-evaluation of stock values, leading to volatility in equity markets.

- Investors are closely monitoring the implications of this downgrade on various sectors, specifically those sensitive to economic growth patterns.

Market Response: With Goldman’s new outlook, sectors that thrive on robust economic performance, such as technology and consumer discretionary, might face increased pressure. Conversely, defensive sectors may see a rise as investors shift strategies in search of stability amid uncertainty.

Future Implications: The economic landscape may continue to evolve as analysts digest the implications of these adjustments. Investors are advised to stay informed and consider how future economic data releases might further influence market dynamics.

Overall, Goldman’s downgrade serves as a reminder of the interconnectedness of economic health and stock market performance. Caution and strategic planning will be crucial for investors navigating this shifting landscape.

Leave a Reply