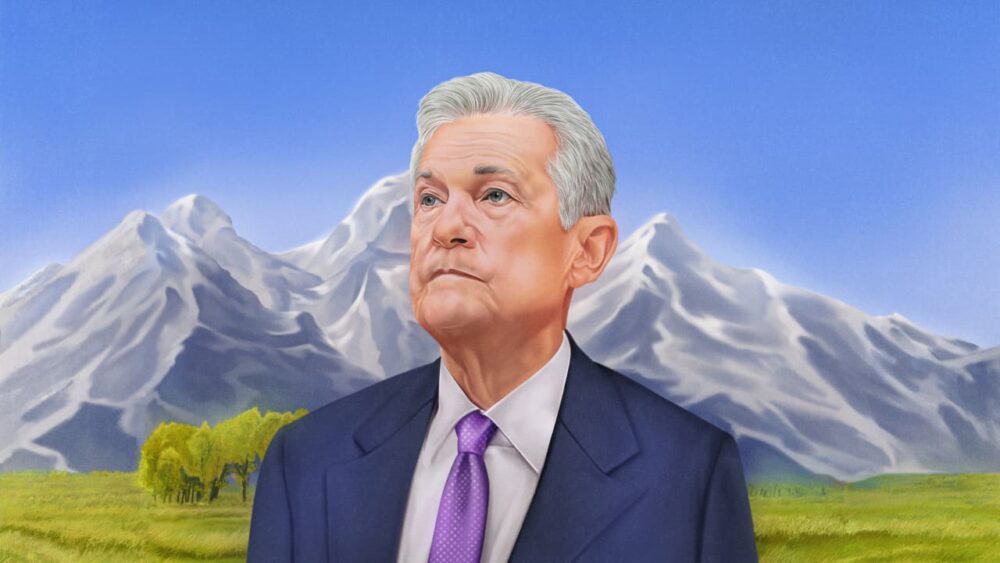

Evercore Research Insights recently analyzed the implications of Federal Reserve Chair Jerome Powell’s upcoming speech at the Jackson Hole Economic Symposium. As speculation mounts regarding potential interest rate adjustments, experts from Evercore are interpreting Powell’s speech as a significant indicator of future monetary policy decisions.

Key Takeaways:

As Powell prepares to address the economic challenges that lie ahead, traders and stakeholders alike will be eager to decipher any implications for interest rates. With uncertainty surrounding the Federal Reserve’s trajectory, the insights from Evercore could be pivotal for market participants.

In conclusion, the speculation around Powell’s Jackson Hole speech underscores the intricate relationship between monetary policy and market stability. As we approach this critical event, staying informed will be essential for making savvy financial decisions.

Leave a Reply