Recent Findings from the Dallas Federal Reserve

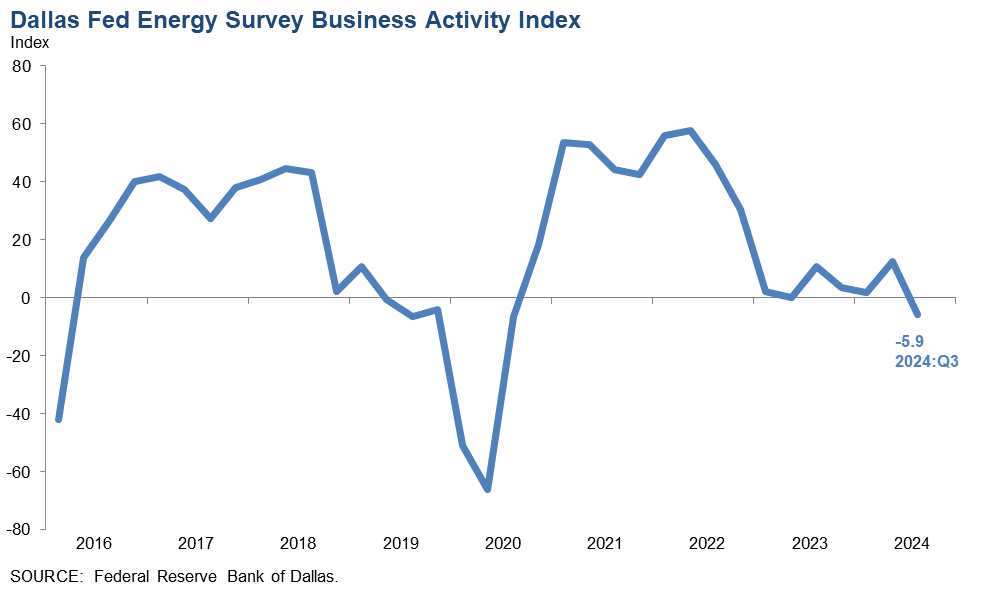

In a new survey conducted by the Dallas Federal Reserve, a noticeable decline in oil and gas activity has been reported for the third quarter of the year. This trend reflects a broader sense of pessimism across the sector, which could have significant implications for energy markets and economic growth.

Key Insights from the Survey:

The Dallas Fed’s survey provides a crucial snapshot of the current state of the oil and gas industry. As companies face an uncertain landscape, it’s essential for stakeholders to stay informed about these trends to navigate potential challenges ahead. In conclusion, while the survey suggests a cooling off in activity, it also provides an opportunity for organizations to reassess strategies and potentially innovate in response to market changes. Awareness of these dynamics will be key for both businesses and investors moving into the next quarter.

Leave a Reply