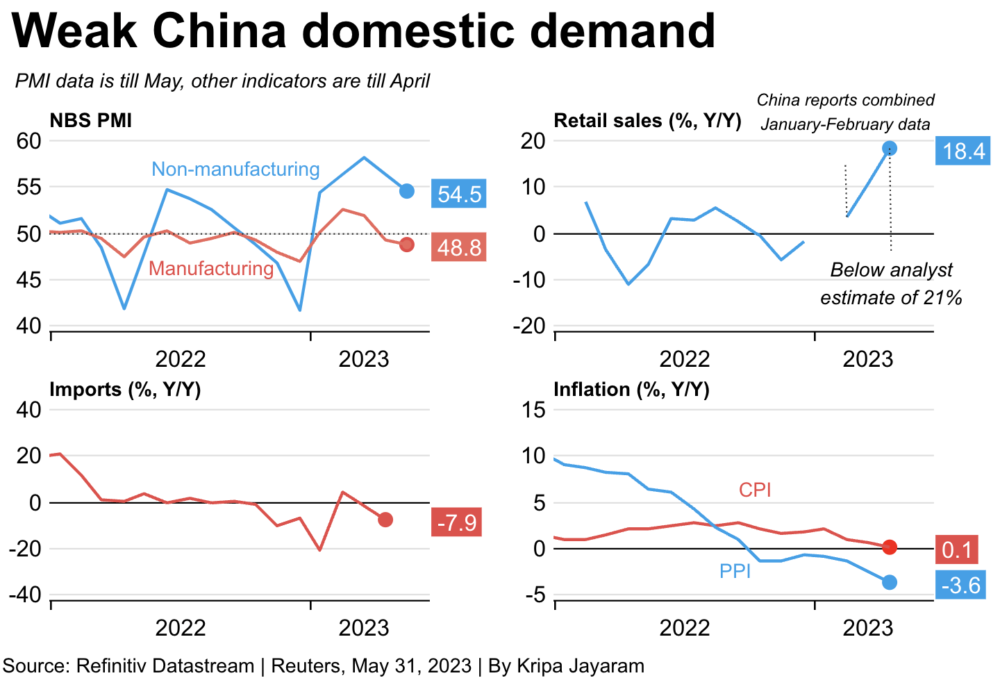

The latest data indicates that China’s Composite Purchasing Managers’ Index (PMI) has contracted for the fifth consecutive month, indicating a slowdown in economic activity driven by sluggish demand.

Analysts closely track the PMI as it provides crucial insights into the health of the manufacturing and services sectors. Here’s a closer look at the situation:

The persistent contraction of the Composite PMI raises questions about the stability of China’s recovery as the country navigates sluggish consumer demand and external economic pressures. It suggests that immediate measures may be needed to stimulate growth in the manufacturing and service sectors.

As we move forward, the focus will likely turn to how policy adjustments and market strategies can reinvigorate demand. Stakeholders are advised to monitor further updates closely to gauge the direction of China’s economic landscape.

Leave a Reply