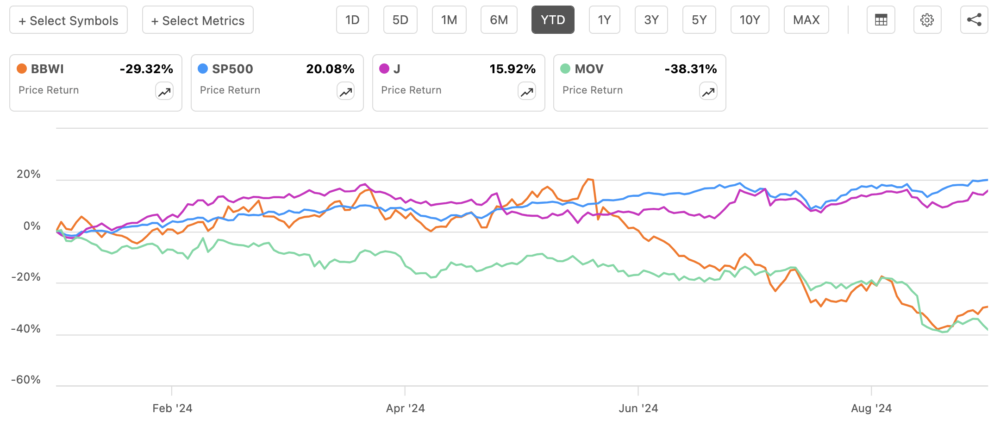

Bath & Body Works has made a significant shift in its market positioning by exiting the S&P 500 and entering the SmallCap 600 index. This strategic move reflects the company’s ongoing evolution in the competitive landscape of retail. As Bath & Body Works transitions, there are several key factors to consider:• Market Dynamics: Bath & Body Works faces a challenging retail environment, prompting this transition. The move to the SmallCap 600 allows the company to realign its strategies and focus on growth opportunities.• Investor Sentiment: Investors may view this shift as a chance for Bath & Body Works to rebuild its brand strength. Smaller companies often have more agile management and the ability to innovate, which could lead to enhanced market performance.• Growth Potential: As a member of the SmallCap 600, Bath & Body Works will likely have access to new investor bases and potentially greater attention from institutional investors aiming to diversify their portfolios.While the exit from the S&P 500 might appear concerning at first glance, it could be an essential step toward rejuvenation. With fresh opportunities, solidified strategies, and a redefined market focus, Bath & Body Works is poised to navigate the path ahead. Investors and stakeholders alike should keep an eye on how this shift impacts the company’s performance in the coming months.Bath & Body Works continues to be a beloved retail brand, and this move may contribute positively to its future trajectory.

Share

Leave a Reply