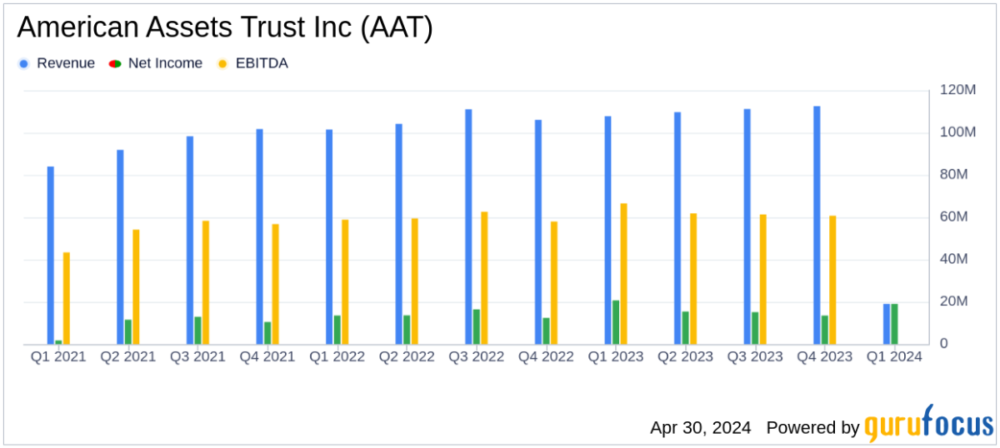

American Assets Trust has recently announced its financial performance for the latest quarter, showcasing impressive results that exceeded analysts’ expectations. The company, which specializes in owning, operating, and developing retail and mixed-use properties, reported a Funds from Operations (FFO) of $0.60 per share, surpassing estimates by $0.06. This performance illustrates the robust operational capabilities of the firm amid challenging market conditions.

In addition to the strong FFO, American Assets Trust also reported revenue of $110.89 million, exceeding expectations by approximately $1.99 million. This positive revenue growth indicates effective management and strategic initiatives that have contributed to the company’s overall success.

Key Highlights from the Earnings Report:

- FFO of $0.60 per share beats estimates by $0.06

- Revenue of $110.89 million beats expectations by $1.99 million

- Continued focus on retail and mixed-use properties

- Strong operational performance amidst industry challenges

This strong performance not only enhances investor confidence but also positions American Assets Trust for potential growth opportunities in the future. With a solid foundation and strategic focus, the company is poised to capitalize on emerging market trends.

Investors and stakeholders alike should pay close attention to upcoming quarterly reports, as the company’s focus on enhancing asset values and expanding its portfolio could yield favorable outcomes in the coming quarters. Overall, the latest results reflect a positive trajectory for American Assets Trust as it continues to navigate the complexities of the real estate market with resilience and innovation.

Leave a Reply