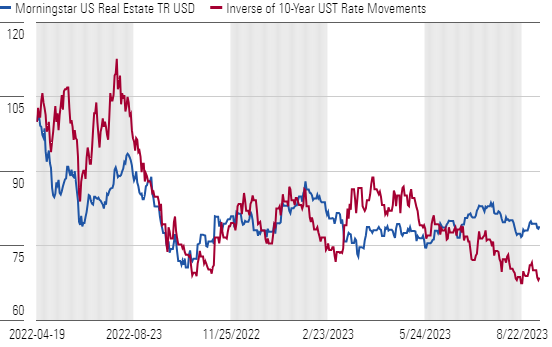

In a surprising market twist, rate-sensitive real estate stocks have emerged as strong performers, outpacing broader market indices. As investors navigated a landscape shaped by fluctuating interest rates, these stocks showcased resilience and growth in an unpredictable economic environment. Here’s why real estate stocks are currently thriving:

Overall, rate-sensitive real estate stocks are not just surviving; they are thriving and attracting the attention of savvy investors looking for stability amid chaos. As the financial landscape evolves, keeping an eye on these real estate contenders could prove beneficial for your investment strategy.

Leave a Reply