Understanding the AI Revolution’s Impact on Global Markets

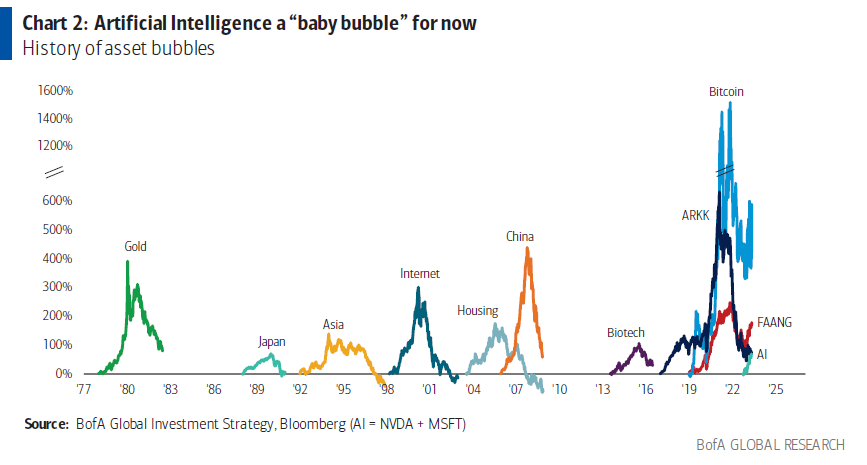

As the world embraces technological advancements, a recent report from Bank of America (BofA) indicates that international stocks are set to become significant beneficiaries of the ongoing ‘AI Revolution’. Here’s a deeper look into how this transformative period could reshape investment strategies and offer new opportunities across global markets.

Key Highlights from the BofA Report:

- AI-Driven Growth: The integration of artificial intelligence into various sectors is expected to enhance productivity and drive profitability, particularly for companies positioned in international markets.

- Emerging Markets Spotlight: Regions such as Asia and Europe are highlighted as potential hotspots for growth, given their adaptability and innovative approaches to technology.

- Sector Leaders: Industries like technology, healthcare, and finance are anticipated to lead the charge, creating favorable conditions for dedicated investors.

- Long-Term Growth Potential: The report suggests that stocks in these areas could offer enhanced long-term returns, leveraging the power of AI for innovative solutions and improvements.

Why This Matters for Investors

With AI technology poised to revolutionize traditional business models, investors should consider reallocating resources towards international stocks. Major advancements in AI could pave the way for a surge in sectors that embrace these innovations, making now an opportune time to diversify portfolios internationally.

Furthermore, understanding the global landscape will be critical, as varying regulations and market dynamics can influence the success of AI integration differently across borders.

In conclusion, BofA’s insights reveal that investors who tap into international stocks may not only align with emerging technological trends but also maximize their growth potential in an increasingly interconnected world. Embracing the AI revolution could lead to substantial returns, thereby shaping the future of investment strategies.

Leave a Reply