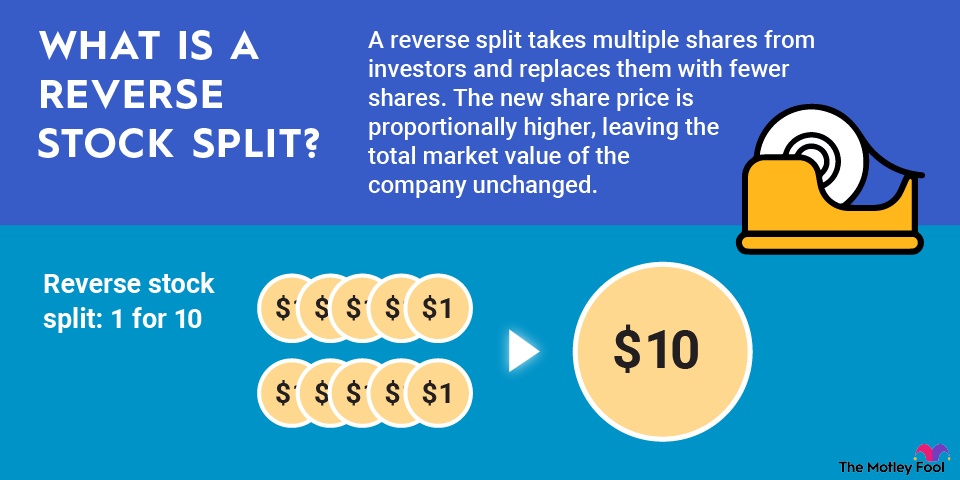

Netcapital Inc., a firm specializing in investment crowdfunding, recently announced a significant corporate decision: a 1-for-70 reverse stock split. This move aims to bolster the company’s stock price and enhance its appeal to investors—an increasingly important strategy in today’s competitive market landscape. The split will result in a consolidation of shares, where every 70 shares previously held by shareholders will now be converted into a single share. This strategic change is set to take effect soon, marking a pivotal moment for the company and its investors.

Here are some key points to consider regarding this announcement:

In summary, Netcapital’s decision to implement a 1-for-70 reverse stock split reflects a proactive step towards improving its market presence and aligning with its long-term strategic goals. Investors should keep a close watch on how this adjustment may influence the company’s trajectory moving forward.

Leave a Reply