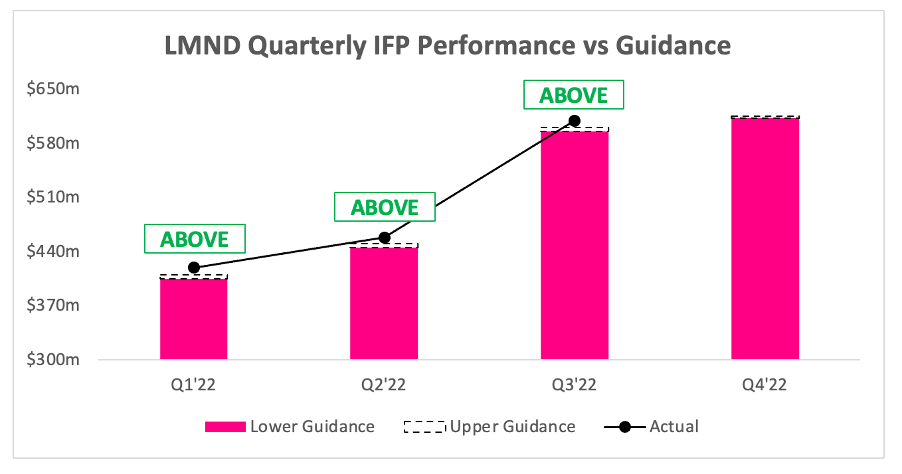

Lemonade Inc., a digital insurance company known for its innovative approach to the insurance industry, has recently faced some turbulence in its stock performance. After releasing its Q2 earnings report, the company issued soft guidance for Q3 revenue, leading to a noticeable decline in its stock price.

Investors were hopeful that Lemonade’s growth trajectory would continue at a robust pace. However, the latest forecast did not meet expectations, prompting reactions from the market. Here’s a closer look at the factors contributing to Lemonade’s current predicament:

While the recent downturn has triggered concern among investors, it’s essential to remember that volatility is common in the stock market, especially in tech-driven sectors like insurance. Lemonade still possesses a strong brand identity and an innovative business model that can propel growth in a rapidly evolving industry.

To sum up, while Lemonade’s current stock prices may reflect short-term uncertainties, the company’s long-term potential remains intriguing. Investors and market watchers will be keenly observing how Lemonade navigates through this challenging period as it focuses on adapting its strategy to align with market demands. The post-earnings landscape always provides opportunities for growth, making it a space worth watching closely in the coming months.

Leave a Reply