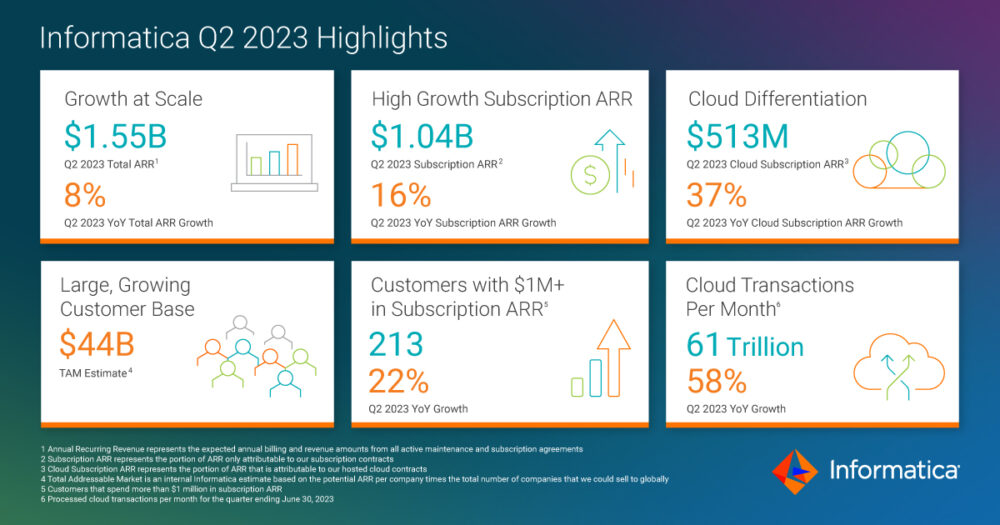

As we approach Informatica’s Q2 earnings results, analysts express an optimistic outlook concerning the company’s performance. With the stock trading at approximately $19, many see strong potential for growth and positive momentum heading into the earnings announcement. Here’s why prioritizing Informatica may be a smart move for investors:

Despite previous volatility linked to external market conditions, Informatica’s fundamentals appear sound as we near earnings season. With a healthy balance sheet and continuous investment in innovation, the company is poised to navigate through challenges and capture market opportunities.

In summary, while the earnings report will be critical to monitor, there is a positive risk-reward scenario developing for Informatica investors. Whether you are a long-term holder or considering adding to your portfolio, keeping an eye on this stock might yield advantageous results in the near future.

Leave a Reply