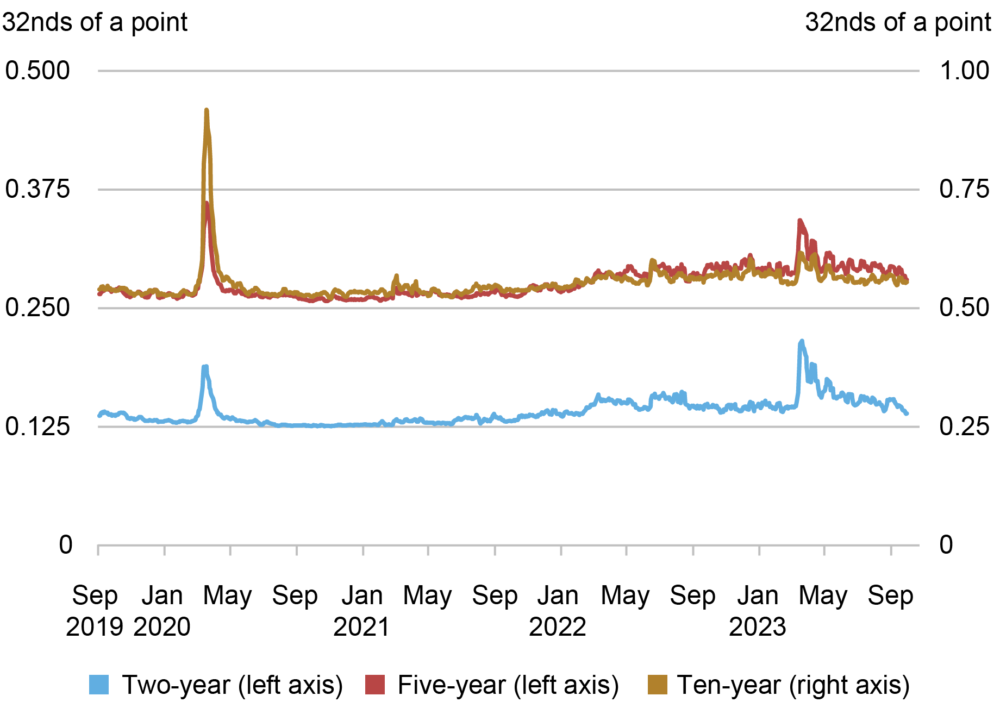

Recent research from the New York Federal Reserve reveals significant shifts in liquidity patterns for U.S. Treasury securities, particularly highlighting a pronounced liquidity rush at the end of each month. This trend emerges largely due to the dominance of passive investment funds, which have become critical players in Treasury trading markets.

As the end of the month approaches, several factors contribute to this liquidity surge:

This pattern of month-end liquidity not only impacts the trading dynamics but also influences broader market conditions. With passive funds accounting for a significant share of market trades, their actions can create increased volatility and price adjustments in the Treasury market.

For market participants, understanding these trends is essential for navigating potential risks and seizing opportunities around month-end trading periods. The findings from the NY Fed underscore the necessity for traders, investors, and analysts to stay alert to these shifts in order to make informed decisions.

Overall, as passive funds continue to influence Treasury market dynamics, attention to liquidity patterns, especially at month-end, becomes vital for robust investment decision-making. Keeping an eye on these trends can lead investors toward optimized strategies that capitalize on predictable market behaviors.

Leave a Reply