Introduction

The financial landscape in Canada is undergoing significant changes, as the Bank of Canada, led by Governor Tiff Macklem, hints at a quicker pace of rate cuts than previously anticipated. This shift in monetary policy comes as a response to evolving economic conditions, aiming to support growth and stabilize the market.

Key Insights from Governor Macklem

According to a recent report by the Financial Times, Governor Macklem’s comments suggest that the Canadian central bank is prioritizing economic adaptability. Key points include:

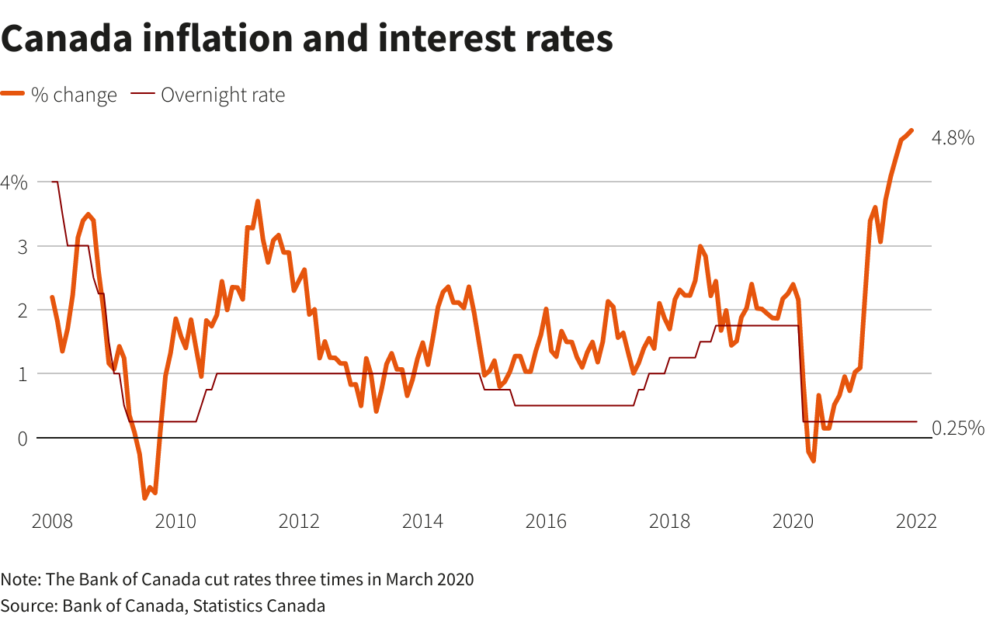

- Increasing rates were intended to combat inflation, but signs indicate a shift towards stimulating economic activity.

- The focus is now on balancing inflation control with growth support, reflecting a more nuanced understanding of current economic pressures.

- As global economic conditions fluctuate, Macklem’s signals point to a proactive stance, ensuring Canada’s monetary policy remains flexible.

The Economic Context

The decision to accelerate rate cuts reflects broader economic trends, including:

- Recent indicators of slowing growth, necessitating a reassessment of monetary policy to foster a more conducive business environment.

- Global economic uncertainties which impact Canadian exports and the overall economy.

- Efforts to alleviate financial burdens on consumers and businesses amid rising costs and economic pressures.

Conclusion

The Bank of Canada’s potential for a faster rate cut pace is promising news for individuals and businesses alike. As the economic climate evolves, these adjustments could pave the way for a healthier Canadian economy, fostering opportunities for growth and stability in challenging times. Investors and financial observers are encouraged to stay tuned for further developments from the central bank, as this policy shift may significantly impact the CAD/USD exchange rate and broader market dynamics.

Leave a Reply